“Wise leverages digital platforms and eliminates intermediary agents to reduce cross‑border money transfer prices. Lower fees translate to increased financial inclusion for average persons without access to modern banking services.”

— Paukunanindita & Minister (2023), in a fintech study highlighting Wise’s impact on international transfers

When I travel in Sweden or other European regions , I always ask myself: should I carry cash or just use my card? I don’t like carrying a lot of cash, and I don’t want to deal with high fees or money problems. That’s why I use the Wise Card in Sweden. It helps me spend easily, save money, and feel safe.

I’ve been living in Sweden for over 15 years, and I travel a lot—across Sweden and the Nordic region. Whether I’m in Stockholm or a small village, the Wise Card works for me. Let me tell you why I love it and why I think it’s a smart choice for travelers.

What Is Wise?

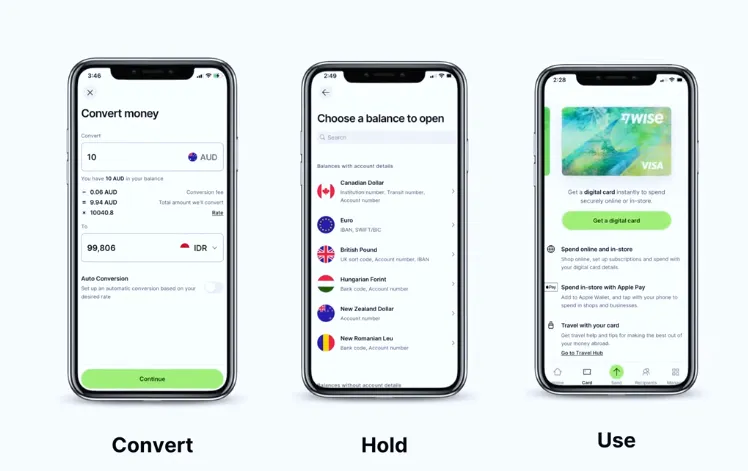

Wise (formerly called TransferWise) is a smart way to manage money when you travel. It gives you a multi-currency account and a debit card. You can spend in many currencies, save on fees, and track your spending in real-time—all from your phone.

It’s not a credit card. You load money into your Wise account and spend only what you have. That means no surprise bills and better control of your budget.

🌍 Key Features of Wise I Love

After using Wise both as a traveler and a resident in Sweden, I’ve grown to rely on it for my daily payments and international transactions. Here’s what makes it one of my favorite financial tools:

💱 Multi-Currency Account

With Wise, I can hold and manage over 40 currencies in one account. Whether I’m spending euros in Germany, kronor in Sweden, or dollars online, I switch currencies instantly without high fees. It’s perfect for traveling across Europe.

🔄 Mid-Market Exchange Rate (No Hidden Fees)

Wise gives me the real exchange rate—the exact one you see on Google. Unlike banks that inflate rates with hidden charges, Wise offers transparency. I always know what I’m paying, and it helps me save money in every transaction.

💳 Wise Debit Card

The Wise card works like a local debit card across Sweden and most countries. I’ve used it at cafes, train stations, grocery stores, and even for online shopping. It also supports Apple Pay and Google Pay, which is super convenient.

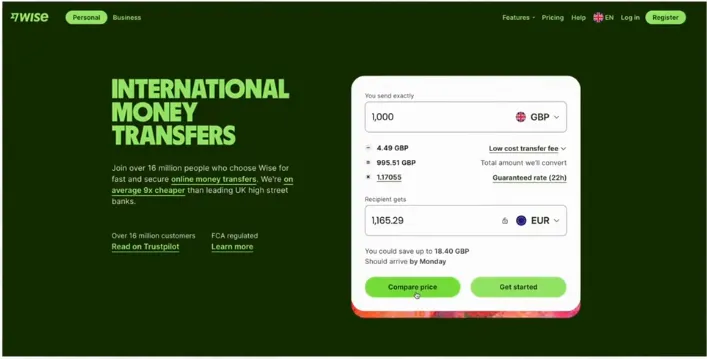

🚀 Fast & Affordable International Transfers

I can send money to 70+ countries, often within minutes. The fees are low and upfront, and Wise shows exactly how much the recipient gets before I confirm. It’s faster and cheaper than most traditional banks.

🏦 Local Bank Details

This is a game changer—Wise gives me bank account numbers in the US, UK, EU, Australia, and more. I can receive money like a local in different regions, which is great for freelancers, remote workers, or digital nomads.

🔔 Real-Time Alerts

I get instant notifications for every transaction. Whether it’s a coffee purchase in Stockholm or a transfer to a friend abroad, I stay updated in real time.

🔒 Card Lock/Unlock from App

Lost my card once in Malmö. Thankfully, I could instantly freeze and unlock it from the app—no need to call a bank or wait hours.

✅ Pros and ⚠️ Cons of Using Wise Card in Sweden

✅ Pros

- Low foreign transaction fees

- Real exchange rates (no markup)

- Easy to use

- Works across Europe

- Multi-currency support

- Apple Pay / Google Pay enabled

⚠️ Cons

- Some ATMs may charge extra fees

- Daily/monthly ATM withdrawal limits

- Card delivery takes a few days

- Can’t deposit cash (online only)

- Needs internet for full features

Even with a few small drawbacks, I think the pros are much stronger. I always feel safe and in control when I travel with my Wise Card.

How I Use Wise in Sweden

In Sweden, most places are cashless. That’s great because the Wise Card works like a regular debit card. I can pay at shops, cafes, trains, and even small markets. If I need cash, I find an ATM (called a “Bankomat”) easily and withdraw Swedish kronor.

The Wise app shows my balance and every payment. It helps me stick to my budget. I never overspend because I always know how much I’ve spent.

Wise Card for European Travel

I also use Wise when I visit other European countries. It works in Denmark, Norway, Germany, and more. I don’t need to open a new bank account or worry about different currencies. Wise handles it all. Just choose the currency you need and go.

Some cards from other countries charge hidden fees. Wise doesn’t. That’s one big reason I trust it.

Frequently Ask Questions

What is a Wise Card?

It’s a debit card you load with money to spend in many currencies. It uses real exchange rates with no hidden fees.

Can I use Wise in Sweden?

Yes, I use it all over Sweden. It works like any regular card at shops, restaurants, ATMs, and online.

Are there fees?

Very small ones. Wise shows them clearly, and they’re much lower than most banks or credit cards.

Is it safe to use abroad?

Yes. It has strong security features, like instant lock/unlock and two-factor login.

Can I use it in other countries too?

Absolutely. It works across Europe and over 200 countries.

Final Thoughts: Travel Smart With the Wise Card

If you travel in Sweden or Europe, I truly recommend the Wise Card. It’s safe, smart, and helps you save money. Whether you’re a tourist or someone who travels often, it can make your trip easier.

I use it for everything—transport, shopping, eating out. It fits my travel style perfectly. I spend less time worrying about money and more time enjoying my journey.

✅ Try Wise Today

Looking for a smarter way to spend while you travel?

👉 Get your Wise Card here – easy setup, low fees, and real exchange rates.